japan corporate tax rate 2022

The content is current on 1 January 2022 with exceptions noted. An under-payment penalty is imposed at 10 to 15 of additional tax due.

A Guide To Corporate Taxes In Japan Japan Tax Guide Tomaコンサルタンツグループ

Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high.

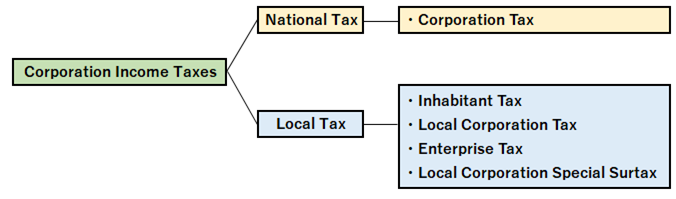

. Income Tax Rates and Thresholds Annual Tax Rate. Corporate income tax rate. If prefectural and municipal income taxes are not withheld by the employer they are to be paid in quarterly installments during the following year.

Japan Income Tax Tables in 2022. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

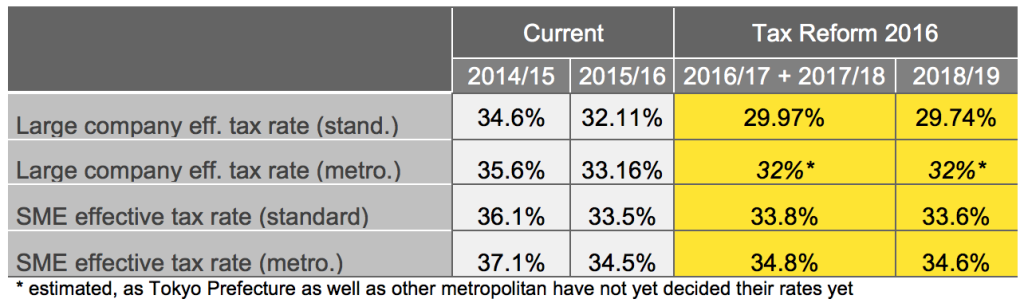

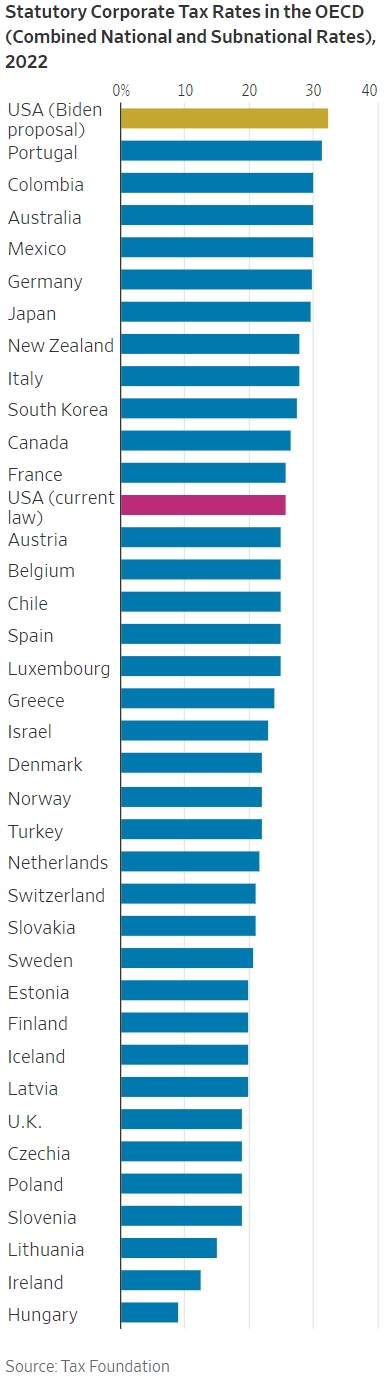

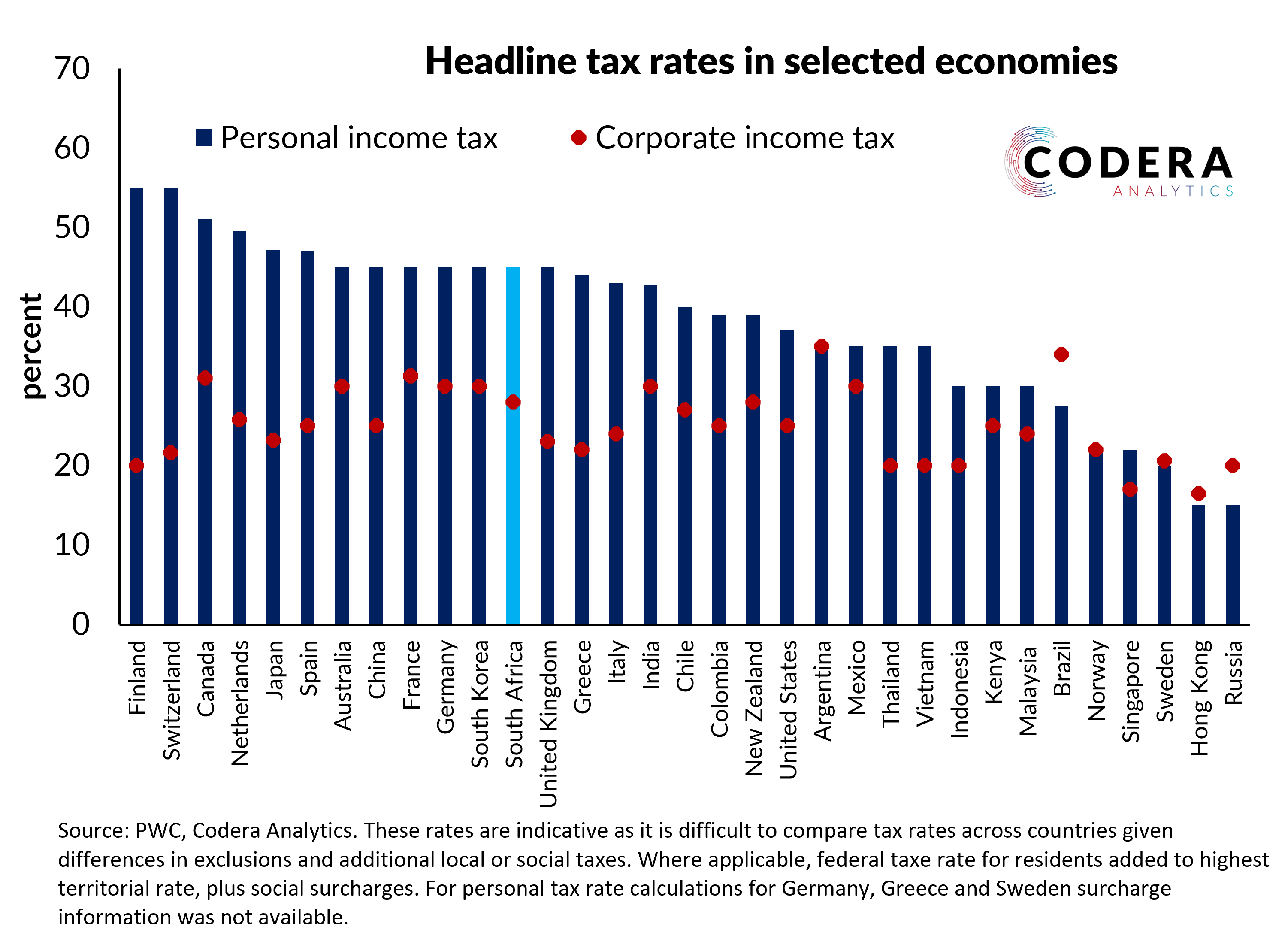

Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally. In Japan generally speaking corporate rates approximately 31 or 35 depending on the amount of the stated capital would be lower than individual rates for individuals who earn.

For example the 2021 taxes are paid in four. In the case that a. 218 rows Comoros has the highest corporate tax rate globally of 50.

Corporate Taxation in Japan. The rate is increased to 10 to 15 once the tax audit notice is received. The Corporate Tax Rate in Japan stands at 3062 percent.

The 2022 tax reform amends this provision whereby if the total compensation paid to specified employees 3 in the current year beginning between 1 April 2022 and 31 March. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in. Puerto Rico follows at 375 and.

Chapter by chapter from Albania to Zimbabwe we summarize corporate tax systems in 160 jurisdictions. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of. Comoros has the highest corporate tax rate globally of 50.

All OECD countries levy a tax on corporate profits but the rates and bases vary widely from. The corporate income tax is a tax on the profits of corporations. Corporate Tax Rate in Japan averaged 4083 percent from.

How Would The Us Corporate Tax Burden Compare With Those Of Other Developed Nations American Enterprise Institute Aei

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

The Four Decade Decline In Global Corporate Tax Rates Reuters

Japan Corporate Tax Rate 2022 Take Profit Org

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Know More About The Corporate Taxes In Japan Damalion Independent Consulting Firm

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Japan Tax Reform 2016 Japan Industry News

Biden S Anti Competitiveness Tax Grab International Liberty

Japan Clears Way For Corporate Tax Cut Wsj

Corporate Tax Rate Pros And Cons Should It Be Raised

Daan Steenkamp On Twitter South Africa S Headline Personal And Corporate Tax Rates Are Relatively High Compared To The Median Rates Across Major Economies Read More Https T Co H3hzmzsmie Https T Co Jinxowy09u Twitter

Corporate Income Tax Cit Rates

Japan Corporate Tax Rate 2022 Data 2023 Forecast 1993 2021 Historical Chart